The development and trend for medical dressing all over the world

1.1 Competitive landscape of global medical dressings industry

According to the "2021 China Medical Dressing Market Research Report" released by the China Investment Industry Research Institute, due to the relatively developed economic level, strong awareness of healthcare among residents, and a more obvious trend of population aging, developed economies such as the United States, Europe, and Japan are the world's most important medical dressing consumption markets. With their technological and talent advantages, these countries and regions have many globally renowned large pharmaceutical multinational enterprises, It covers a wide range of business categories and product types, with products sold to multiple countries and regions. Its brand and enterprise awareness and market share are relatively high. Internationally renowned medical device companies involved in the field of medical dressings include 3M Company, Sweden's Menik, UK's Xerox Hui, Denmark's Conrad, and the United States' Conrad.

Since the 1990s, with the continuous increase in labor costs in developed countries, large multinational medical device companies have gradually shifted the production process of traditional wound care products (such as gauze and bandages) with high labor demand and low technological content in medical dressings to regions and countries such as Asia and South America, retaining research and development and marketing links, and selling them in the market under independent brands. With its advantages in labor costs and industrial chain, China has taken on this wave of industrial transfer and gradually formed a group of medical dressing production enterprises engaged in OEM (OEM) and export-oriented for international large medical dressing brands, such as Steady Medical, Aomei Medical, Zhende Medical, etc. At present, China has become the world's largest exporter of medical dressings, with an export value of 2.716 billion US dollars in 2019. The quality of traditional wound care products has reached the world's leading level, but there is still a certain gap between China and developed countries in product innovation, research and development investment, talent and technology level, equipment level, and global marketing network construction.

1.2 Overall scale of China's medical dressings market

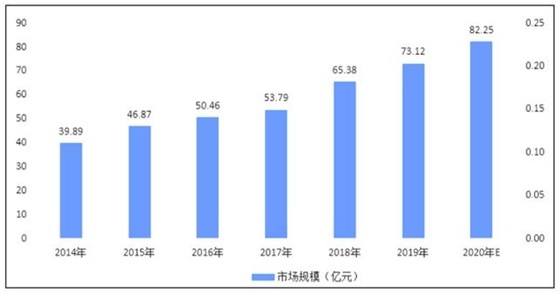

According to the "2021 China Medical Dressing Market Research Report" released by China Investment Industry Research Institute, medical dressings refer to medical materials used to cover ulcers, wounds, or other damages, and belong to nursing and protective equipment in medical devices. In recent years, with the improvement of medical conditions in China and the enhancement of residents' health awareness and consumption level, the medical dressing market in China has steadily grown. In 2019, the market size of medical dressings in China was approximately 7.312 billion yuan. It is predicted that by 2020, the market size of medical dressings in China will reach 8.225 billion yuan.

Table: Market size of medical dressings in China from 2014 to 2020

1.3 Market space for infection control products in medical dressings and operating rooms

According to the 2021 China Medical Dressing Market Research Report released by the China Investment Industry Research Institute, the market for infection control products in the operating room is showing a sustained growth trend due to the increase in the number of surgical procedures and the strengthening of infection control measures. According to the statistics of CMI, the market size of surgical room infection control products is expected to reach 3.688 billion US dollars by 2026, with an average compound annual growth rate of 4.9%.

Surgical room infection control products can be divided into reusable and disposable types. The shift from reusable products to disposable products has become a trend in the industry. The main reasons include: on the one hand, disposable surgical infection control products can significantly reduce the risk of cross infection compared to reusable products. According to a report by Coherent, Disposable surgical room infection control products can reduce the risk of cross infection during surgery by 60%. The Operating Room Nursing Practice Guidelines developed by the Operating Room Professional Committee of the Chinese Nursing Society also recommend the use of disposable sterile products in the operating room. On the other hand, disposable surgical room infection control products also have advantages in terms of convenience, cost, and other aspects compared to reusable products, making the demand for disposable products even stronger.

Compared to individual products, the market size of customized surgical combination packages will show a rapid growth trend. According to the statistics of CMI, the global market size of customized surgical combination packages is expected to grow to 21.347 billion US dollars in 2026, with an annual compound growth rate of 10.2%. Among them, the scale of customized surgical combination packages in China is expected to rise to 1.504 billion US dollars, with an annual compound growth rate of 12.2%, indicating a very promising market prospect.

Send Email

Send Email rainny

rainny